About Us

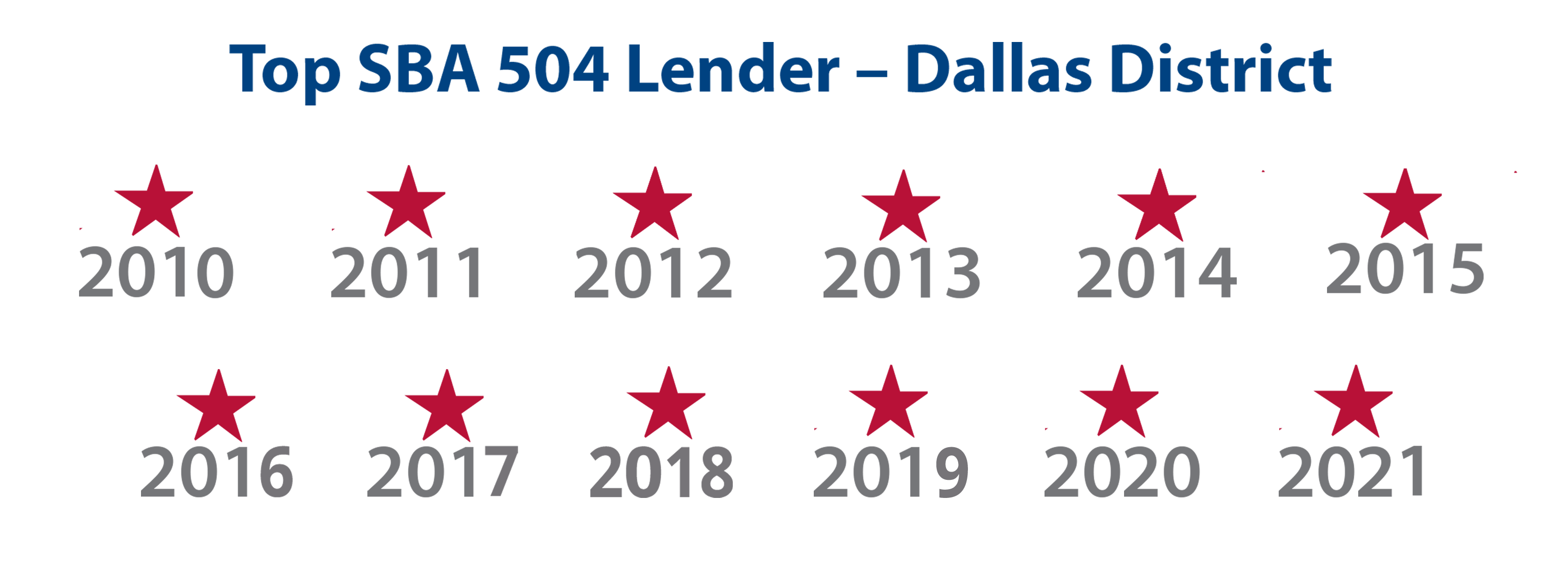

Greater Texas Capital Corporation, one of nations’ fastest-growing Certified Development Corporations, helps small businesses secure favorable fixed rate financing for real estate and equipment. As a Certified Development Corporation (CDC), we are a nonprofit company specifically established to contribute to economic development. We work with the Small Business Administration (SBA) and other lending partners to provide loans to small businesses requiring real estate and equipment financing with long-term, fixed-rates throughout Texas.

We find solutions. GTCC looks for ways to get projects done. We help navigate potential red-tape roadblocks to find and smooth the path for our clients. Our superb track record of funding projects that are sometimes more challenging arises from our deep knowledge of regulations and procedures and our close relationships with government agencies and lenders. By combining the SBA 504 loan with companion commercial loans, we feel that this is the best option for small business to finance their real estate or equipment needs.

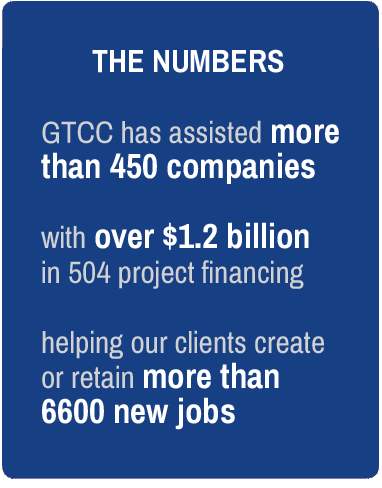

Decades of expertise strengthen GTCC. The company, originally named Greater East Texas Certified Development Corporation (GETCDC), was formed by in 1995 at the request of the SBA to serve small businesses in a seven-county East Texas area. Since that time, we have provided over 568 loans for projects totaling over $1.4 billion

We have done loans throughout Texas – from a livestock arena in Texarkana to warehouse in El Paso and many large and small cities in between. The majority of our loans are originated in Dallas/Fort Worth and East Texas.

Our Difference

GTCC excels due to extensive experience, top-notch customer service, and attention to detail. With our years of specific 504/SBA experience, we have an in depth understanding of what it takes to carry a borrower’s idea and application through SBA approval and funding. We provide banks with a positive financing alternative which allows them to have confidence in the process and say “yes” to a borrower’s financing needs. We view our role as a trusted advisor and lending partner, and we will work to make sure the process is as smooth and efficient as possible.

GTCC Executive Team

Todd Buchanan

Todd joined Greater Texas Capital Corporation (GTCC) in 2012 and has served as President since 2016. He also leads Lending Avenue, a community initiative launched by GTCCF—GTCC’s subsidiary and an emerging Community Development Financial Institution (CDFI).

Todd brings over two decades of diverse business experience to his role. Prior to GTCC, he spent six years as a business consultant, advising both small businesses and large corporations in areas including finance, mergers, and acquisitions. He also spent 17 years in corporate leadership roles across accounting, finance, and operations.

A committed industry leader, Todd is currently serving his third term as Region VI Director for the National Association of Development Companies (NADCO), where he also serves on several key committees, including the Executive Committee.

Deeply invested in his community, Todd actively serves on the leadership team at Redemption Church – Tyler and sits on the boards of several local organizations and is a proud graduate of Leadership Tyler, Class 27.

Greg Dunn

Director of Sales and Marketing

Greg joined Greater Texas Capital Corporation in January 2009, and is responsible for new loan originations and marketing. Greg has over 25 years of sales, credit, and management experience with local and national lenders. His expertise in utilizing SBA programs, as well as conduit and conventional financing, is a strong advantage for the borrowers, bank referral sources, and intermediaries that work with him.

He also serves as Past President and currently serves on the Board of North Texas Association of Government Guaranteed Lenders (NTAGGL), the premier trade organization dedicated to serving and supporting small businesses utilizing SBA Loan Programs in the Dallas/Fort Worth area.