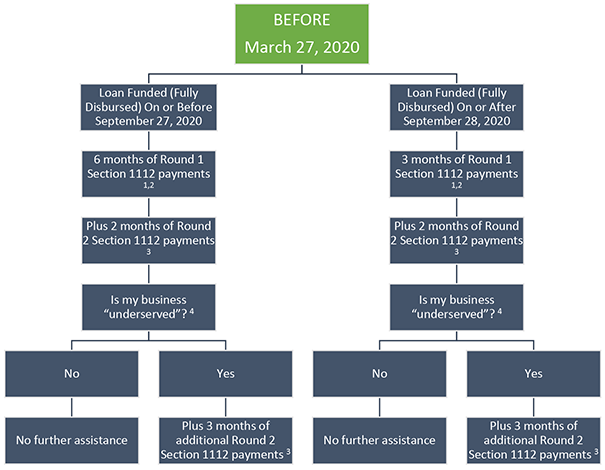

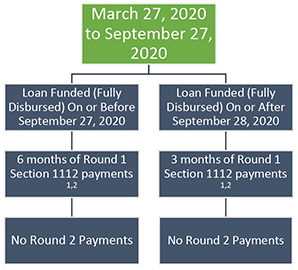

CARES Act Section 1112 Payments based on SBA Loan Approval Date

SBA “Adjustment Plan” effective February 16, 20218

SBA DEFINED HARD HIT NAICS CODES

| NAICS CODE | INDUSTRY |

| 61 | Educational Services |

| 71 | Arts, Entertainment, and Recreation |

| 72 | Accommodation & Food Services |

| 213 | Support Activities for Mining |

| 315 | Apparel Manufacturing |

| 448 | Clothing and Clothing Accessories Stores |

| 451 | Sporting Goods, Hobby, Book, Music Stores |

| 481 | Air Transportation |

| 485 | Transit, Rail, Bus, Tax, Limo |

| 487 | Scenic and Sightseeing Transportation |

| 511 | Newspaper, Books, etc. Publishing |

| 512 | Motion Picture, Video, Sound Recording Industries |

| 515 | Radio and TV Broadcasting |

| 532 | Rental & Leasing-equipment, consumer goods, etc |

| 812 | Personal and Laundry Services |

Notes

- Round 1 Section 1112 payments must be completed before Round 2 payments can begin

- Round 1 Section 1112 payments are not capped per month

- Round 2 Section 1112 payments cannot exceed $9,000 per month – borrower must pay excess amount or contact CDC/Lender if unable to pay

- “Underserved” – all community advantage (CA) loans; all microloans; and targeted 7(a) and 504 loans to businesses assigned a North American Industry Classification System (NAICS code beginning with 61, 71, 72, 213, 315, 448, 451, 481, 485, 487, 511, 512, 515, 532, or 812

- Businesses that have received (or will receive) debt relief on any other 7(a) loan, 504 loan, or Microloan that was approved March 27, 2020 through September 27, 2020 are not eligible for Section 1112 payment assistance on any new loan approved February 1 to September 30, 2021

- All Section 1112 payments begin with the next payment due on or after February 1, 2021 or beginning with the next payment due after any deferment period granted

- Please refer to NADCO Technical Issues Memo 13‐21 and SBA Procedural Notice 5000‐20079 and NADCO Technical Issues Memo 1‐21 and SBA Procedural Notice 5000‐20095 for complete details

- Reduced number of months of Section 1112 payments (“Adjustment Plan”) effective beginning with payments made in February 2021.